EQUI - Transforming Venture Capital

A market is one of the many varieties of systems,institutions,procedures,social relations and infrastructures whereby parties engage in exchange.While parties may exchange goods and services by barter,most markets rely on sellers offering their goods or services including labor in exchange for money from buyers.It can be said that a market is the process by which the prices of goods and services are established.Markets facilitate trade and enable the distribution and resource allocation in a society.

Venture Capital is an investment in the form of financing in the form of capital participation into a private company as a business partner (investee company) for a certain period. In general, this investment is done in the form of capital surrender in cash in exchange for a number of shares in the company's spouse. Venture capital investment usually has a high risk but gives a high yield.A venture capitalist (VC), is an investor who invests in a venture capital company.

These venture funds manage investment funds from third parties (investors) whose primary purpose is to invest in a company with high risk so that it does not meet the requirements of the standards as an open company or to obtain loan capital from the banking. Venture capital investment can also include the provision of managerial assistance and technical. Most of these venture funds come from a group of well-established financial investors, investment banks, and other financial institutions that make fundraising or partnerships for the purpose of the investment. Capital investments made by venture capital are mostly done on newly established companies so that they do not have an operational history that can be a record in order to obtain a loan. As a form of entrepreneurship, venture capital owners usually have voting rights as a determinant of the direction of company policy in accordance with the number of shares owned.

With blockchain technology, and cryptocurrencies in particular, which have recently been the subject of major media attention, it seems appropriate to explore the role of venture capital in a decentralized market. Blockchain technology is growing in popularity as large companies and start-up companies alike see emerging markets for various applications beyond crypto, including documenting legal contracts and shipment tracking. Blockchain is basically a new way to store and record transactions; At first glance it seems very similar to a general ledger or a traditional database, except for the fact that "blocks" are all interconnected cryptographically, thus forming a rigorous system of fraud, corruption, etc.Introducing a new Project that will bridge the usual venture capital upgraded with blockchain technology that is EQUI.

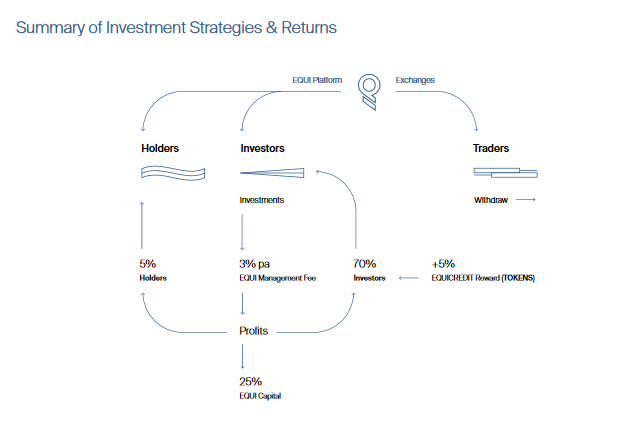

EQUI is a web-based application on the popular Ethereum blockchain. Projects are showcased on the platform and participants use EQUI tokens to acquire a stake in projects. Upon completion of the project, returns are then distributed to the venture’s investors.Through a unique reward structure, each EQUItoken holder will benefit from the returns generated from the realized project, ensuring that all interests remain aligned throughout the life of the project. EQUI strives to reward participants who share our vision, offering an enhanced incentive structure for those who invest their EQUItokens in the underlying investment projects that are on display on the EQUI platform. Investors who have commitment to opportunities on the EQUI platform will receive 70% of the profit generated.

There is no limit to the number of projects that have been selected to be invested.

In return, Investors will receive further EQUItokens allocation through the EQUIcredits loyalty system, which is calculated at 5% of the EQUItokens investment amount.

Vision

CRYPTO CURRENCY & COINS

A major component in the rise of blockchain has been ‘Cryptocurrency’, otherwise known as ‘virtual currency’ or ‘digital money’. As the names suggest, this is not ‘money’ in the sense that there are no physical attributes to be held - no coins, notes, gold or diamonds. The virtual currency exists solely in digital form within a decentralised network.

There are currently over 1,500 cryptocurrencies available, with Bitcoin and Ethereum taking the largest share of the market. We are now seeing a number of large financial institutions, who had previously steered away from blockchains and cryptocurrencies, publicly announcing their plans to invest in building their own blockchains, or their plans to participate in blockchain research and make digital alliances. This movement is furthered by major corporates who are adopting the technology into their practices.

A major component in the rise of blockchain has been ‘Cryptocurrency’, otherwise known as ‘virtual currency’ or ‘digital money’. As the names suggest, this is not ‘money’ in the sense that there are no physical attributes to be held - no coins, notes, gold or diamonds. The virtual currency exists solely in digital form within a decentralised network.

There are currently over 1,500 cryptocurrencies available, with Bitcoin and Ethereum taking the largest share of the market. We are now seeing a number of large financial institutions, who had previously steered away from blockchains and cryptocurrencies, publicly announcing their plans to invest in building their own blockchains, or their plans to participate in blockchain research and make digital alliances. This movement is furthered by major corporates who are adopting the technology into their practices.

The EQUI proposition offers participants both flexibility and control in the making of investment decisions,EQUItokens can be bought for various reasons :

Investors

Investors are those participants who commit EQUItokens to

opportunities on the EQUI platform. The level of commitment is

completely flexible and is determined by the investor’s appetite

in a particular project. Investors will receive 70% (pro-rata) of the

profits* generated from projects they invest in

As a further reward mechanism, investors will participate in

the EQUIcredits loyalty scheme. The allocation of EQUIcredits

equates to 5% of participants’ invested EQUItokens. EQUIcredits

awarded will be converted to EQUItokens at the end of every year

and transferred to EQUI wallets. The generation of EQUIcredits

derives from a 5% annual increase in the overall EQUItoken

supply.

opportunities on the EQUI platform. The level of commitment is

completely flexible and is determined by the investor’s appetite

in a particular project. Investors will receive 70% (pro-rata) of the

profits* generated from projects they invest in

As a further reward mechanism, investors will participate in

the EQUIcredits loyalty scheme. The allocation of EQUIcredits

equates to 5% of participants’ invested EQUItokens. EQUIcredits

awarded will be converted to EQUItokens at the end of every year

and transferred to EQUI wallets. The generation of EQUIcredits

derives from a 5% annual increase in the overall EQUItoken

supply.

Holders

Holders are those participants who choose to hold their tokens

on the EQUI platform without committing to projects. Holders

receive 5% (pro-rata) of profits generated from projects.

Traders

Traders are participants who choose to remove their tokens from

the EQUI platform and benefit only from any enhancement in the

token price

All EQUItoken holders will have access to the platform and the ability to review an evolving

selection of investment projects. All showcased projects will have been assessed and

evaluated by the EQUI Investment Team prior to publication. Stakes can then be acquired

in project(s) of interest using EQUItokens.

75% of all profits are returned to Investors and Holders. The remaining 25% goes to

the EQUI Investment Team as a performance reward. This structure has been designed

to ensure that the interests of all parties remain aligned at all times thereby deriving

maximum value for all stakeholders.

EQUI Capital

EQUI Capital is an early-stage venture fund, supporting visionary technology entrepreneurs in building leading companies. The EQUI team has a breadth of experience spanning all aspects of business making them well equipped to partner with entrepreneurial ventures and achieve success.

EQUI Capital aims to be the primary portal for ambitious entrepreneurs looking to pioneer their visions into reality. The focus for investment selection places an emphasis on technological advances with a bias towards blockchain technology. Businesses must address a significant market opportunity and offer the potential to grow into the market leaders of tomorrow.

As well as offering financial backing, the EQUI Capital team provide ongoing mentorship, resources, operational support and strategic guidance. This invaluable input will enable ambitious companies to grow and succeed and provide returns for all stakeholders.

EQUI Capital is an early-stage venture fund, supporting visionary technology entrepreneurs in building leading companies. The EQUI team has a breadth of experience spanning all aspects of business making them well equipped to partner with entrepreneurial ventures and achieve success.

EQUI Capital aims to be the primary portal for ambitious entrepreneurs looking to pioneer their visions into reality. The focus for investment selection places an emphasis on technological advances with a bias towards blockchain technology. Businesses must address a significant market opportunity and offer the potential to grow into the market leaders of tomorrow.

As well as offering financial backing, the EQUI Capital team provide ongoing mentorship, resources, operational support and strategic guidance. This invaluable input will enable ambitious companies to grow and succeed and provide returns for all stakeholders.

The Proposition

EQUI will be a sustainable investment platform. Utilising Ethereum blockchain technology, it will enable all qualifying participants to benefit from returns generated. EQUI’s unique reward structure is weighted towards providing enhanced returns to those who share our vision and objectives in supporting the next generation of entrepreneurial sucess.

All EQUItoken owners will have access to the platform and the ability to review an evolving selection of investment projects. All showcased projects will have been assessed and evaluated by the EQUI Investment Team prior to publication. Stakes can then be acquired in project(s) of interest using EQUI tokens.

EQUI will be a sustainable investment platform. Utilising Ethereum blockchain technology, it will enable all qualifying participants to benefit from returns generated. EQUI’s unique reward structure is weighted towards providing enhanced returns to those who share our vision and objectives in supporting the next generation of entrepreneurial sucess.

All EQUItoken owners will have access to the platform and the ability to review an evolving selection of investment projects. All showcased projects will have been assessed and evaluated by the EQUI Investment Team prior to publication. Stakes can then be acquired in project(s) of interest using EQUI tokens.

Tokens & ICO

Bonus incentives are provided to early adopters. The table below sets out the timetable for the launch of the ICO:

ASSET NAME : EQUI

TOTAL TOKEN SUPPLY : 250 million EQUItokens

PRICE IN USD : $0.50

PAYABLE IN : Bitcoins (BTC), Ethereum (ETH), Litecoins (LTC), Ripple (XRP)

A pre-sale will run from 1 March to 8 March 2018.

A minimum investment level of $100,000 is required to participate in the pre-sale.

The public ICO will run from 8 March to 31 March 2018.

A minimum investment level of $100 will apply to the public ICO, subject to participants complying with regulatory guidelines.

Token Distribution

The distribution of EQUItokens focuses on creating long term value for investors:

- 65% of the tokens will be made available to the public via the pre-sale and ICO process.

- 12% will be distributed to the EQUI Founders, subject to a six month lock-in period.

- 15% will be distributed to the EQUI Team, quarterly, over a two year period, subject to a six month lock-in period.

- 6% will be distributed to the Advisory Board quarterly, over a two year period, subject to a six month lock-in period.

- 2% will be available for Bounty Rewards.

Use of Proceeds

The funds raised from the ICO will enable the completion of the EQUI decentralised investment platform as outlined in our Roadmap on page 32. Funds will also be allocated to provide the necessary infrastructure and resource to sustain the EQUI business. Any surplus funds will be used by EQUI to invest in projects alongside token holders.

Roadmap

TEAM

DOUG BARROWMAN — lead founder

DOUG BARROWMAN — lead founder

Doug is successful businessman with many years of experience, who spent most of his career time for investing and operation businesses. Age 22, his first venture was to open 3 paintball sites in Scotland. Awards followed, and his success resulted in international private equity group 3i recruiting him to their investment team. In 1992, he decided to branch out on his own again, setting up and developing a successful corporate finance practice which he exited in 1999 to concentrate on his private investment vehicle, Aston Ventures. Over the next 10 years, Aston Ventures made 13 acquisitions of old economy businesses with a total turnover in excess of £400 million. In recent years Aston has focused on technology investments and in 2017 led the acquisition of former tech unicorn Ve Global. Since 2008, Doug built the Knox Group of Companies, as a Founder and Chainman. Nowadays, Knox employs over 350 staff across a number of international locations, and has funds under management and administration almost 3 billions GBP!

ARONESS MONE OF MAYFAIR — co-founder

Michelle is one of the most powerful and dominant businesswoman in United Kindom. She found and managed Ultimo Brands International. Her lingerie empire spanned the glode. Over the past years, she has invested in technology business and get interested in cryptocurrency market.

Investment team:

— TIM EVE — investment director;

— LUKE WEBSTER — investment director & compliance;

— MARK LYONS — investment director;

— ANDREW BARROWMAN — investment manager.

Project team:

— ANDREI KARPUSHONAK — head of development;

— NICHOLAS GRAHAM — head of customer services;

— NERYS ROBERTS — marketing director;

— SIM SINGH-LANDA — project manager;

— ANTHONY PAGE — trustee;

Advisory team:

— MARK PEARSON;

— MORTEN TONNESEN;

— JONAS KARLBERG;

— JOHN CALDWELL;

— DUNCAN CAMERON;

Curious about EQUI, watch here:

For More Information, please visit here :

EQUI Website : https://www.equi.capital/

EQUI Twitter : https://twitter.com/equi_capital

EQUI Telegram : https://t.me/equicapital

EQUI Facebook : https://www.facebook.com/equi.capital/

EQUI Facebook : https://www.facebook.com/equi.capital/

EQUI ANN Thread : https://bitcointalk.org/index.php?topic=2888110.new#new

EQUI Medium : https://medium.com/equi-capital

EQUI Medium : https://medium.com/equi-capital

Komentar

Posting Komentar