INVOX FINANCE - The Most Innovative Invoice Lending Platform

What is Invox?

The Invox Finance Platform is a decentralised peer-to-peer invoice lending platform that will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information.

What does this really mean?

It means they are creating a p2p decentralized form of factoring or invoice financing.

If you're not familiar with invoice financing it is when a business allows a third party to purchase the rights to money they are owed (for product or service) at a discount.

The benefit to the business is that they receive money immediately which allows them to do things like make payroll, purchase additional supplies, acquire more jobs.

Invoice financing is a huge business globally because many businesses have to wait up to 90 days to receive payment for their products.

Give me an example

A chair manufacturer, Chair Co., sells an order of $1000 worth of chairs to J. Dudley Furniture to fulfill a customer order. J. Dudley will not pay the chair company until the 30 day return period for the retail customer has been exhausted.

Meanwhile, Chair Co. has been offered another contract by B. Bubbles Designs for $2000 worth of chairs. Since Chair Co. is currently lacking cash due to the investment in supplies and lack of return on their first shipment they will have to decline the contract.

Or they can seek invoice financing via Invox. Chair Co. would digitize the invoice, with the permission of J.Dudley, into a Dynamic Invoice Smart Contract and offer it for sale on the Invox Platform.

The terms of the invoice loan would be placed in a Loan Smart Contract and when purchased the funds will be directed to the Chair Co. At the end of the loan cycle (30 days in this example), J. Dudley would then pay the smart contract which would distribute to the loan financiers.

How will Invox Finance Platform solve the problem?

The Invox Finance Platform is a decentralised peer-to-peer invoice lending platform that will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information. The platform aims to create a trusting environment by facilitating transparency between parties and rewarding performance.

This platform will disrupt and revolutionise traditional invoice financing by implementing a system where trust and transparency between all parties is developed through an in-built reward system.

In addition, the execution of transactions and flow of information will not be dependent on one single centralised service provider, but instead governed by a transparent set of rules executed on a fully distributed ledger. Read more on the Whitepaper

In addition, the execution of transactions and flow of information will not be dependent on one single centralised service provider, but instead governed by a transparent set of rules executed on a fully distributed ledger. Read more on the Whitepaper

The Platform Overview

The Invox Financial Platform overview will consist of the following

Dynamic Invoice Smart Contracts

Loans Smart Contracts

User Access and Processing Hub

Bank API Integration

Use of Invox Token?

Loans Smart Contracts

User Access and Processing Hub

Bank API Integration

Use of Invox Token?

providing access to the platform through the Trusted Member Program

Award work is done for the platform. That is, the system

will reward buyers and sellers with Invox Tokens for invoices

verification, invoice payment and settlement.

Award work is done for the platform. That is, the system

will reward buyers and sellers with Invox Tokens for invoices

verification, invoice payment and settlement.

What is the Invox token for ?

- Sellers are required to use INVOX to pay for year subscriptions that allow them to sell their invoices.

- Rewards for buyers and sellers for the verification and repayment of invoices.

Who will use Invox?

Invox is targeting small and midsize enterprises as buyers and sellers and non-retail investors as the purchasers of invoices.

Buyers and sellers will be motivated to move to Invox because of lower fees, increased security and possibility of rewards.

Initially the platform will only allow non-retail investors to participate in the investment platform. These include large businesses, individuals that invest more than $500,000 AUD, or those investors with net assets of at least $2.5m AUD or with gross incomes of at least $250k AUD. This is a much different approach than a similarly focused project (Traxia) that allows any investor to purchase invoices.

Over time INVOX will allow retail investors to participate in funding.

What is the revenue model for Invox?

The Invox Finance Platform will generate revenue by charging fees to the sellers and investors. Buyers are not charged for using or accessing the Invox Finance Platform, nor are third parties who provide value to the Invox Finance Platform.

- Sellers will pay a 1.1% fee (in INVOX) to list invoices for sale. Of this fee, .1% will return to Invox Finance and 1% will be returned as rewards.

- Investors will be charged a 1.1% fee to purchase invoices.

Token Information

Invox Token will be created on the Ethereum Network. With the Finance system, the company will be launching a token of its own called as Invox Token. It’ll be given to buyers and sellers as a reward for verification of transactions. It’s also essential for the sellers to have an Invox token to access the Invox Finance platform. The sellers will have to pay a certain amount of them for a yearly membership.

The company also is launching an ICO, the purpose of it is to pre-sale the membership through the sale of Invox tokens. You get the tokens at a discounted price for participating in the ICO. For more details, you can check the website: https://invoxfinance.io/

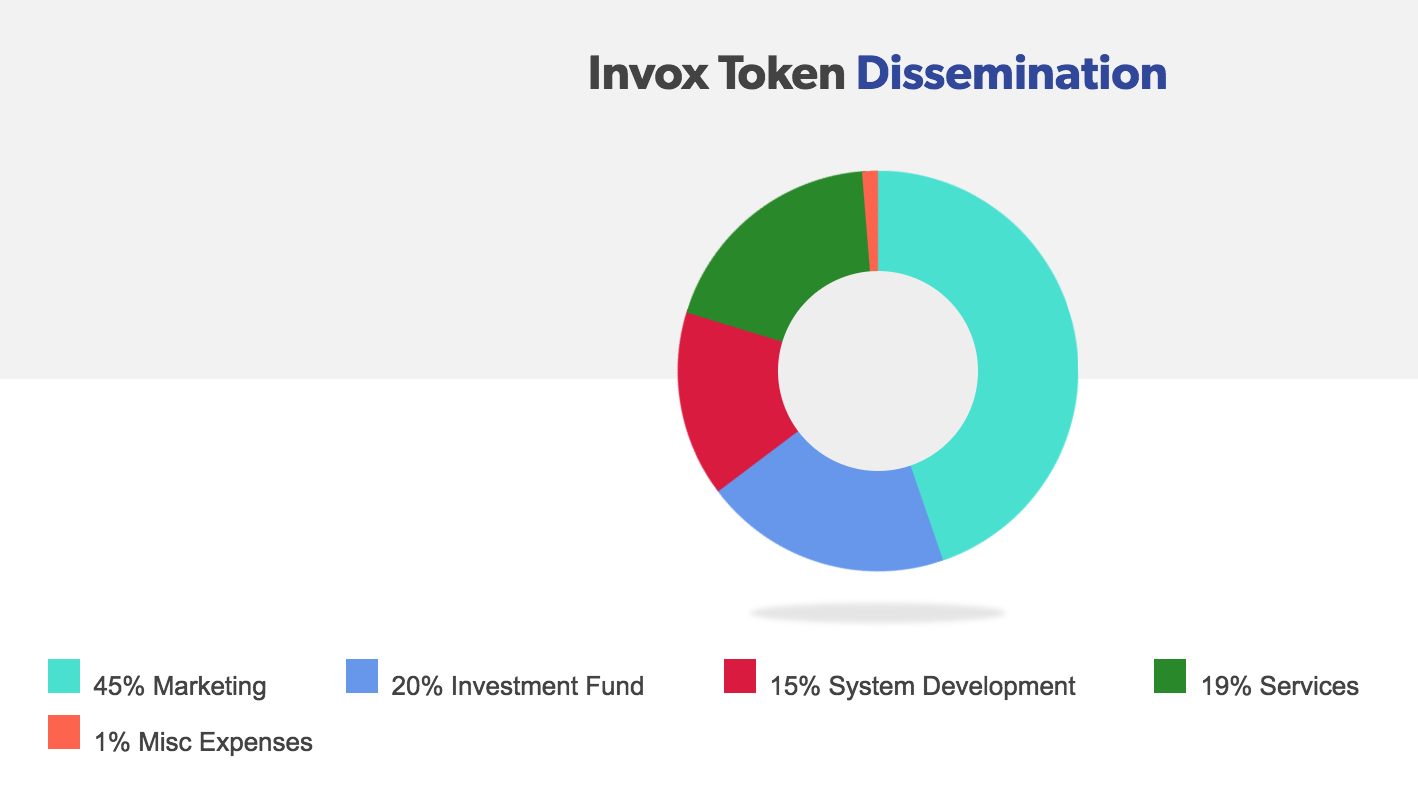

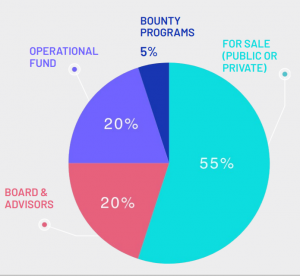

Token Allocation

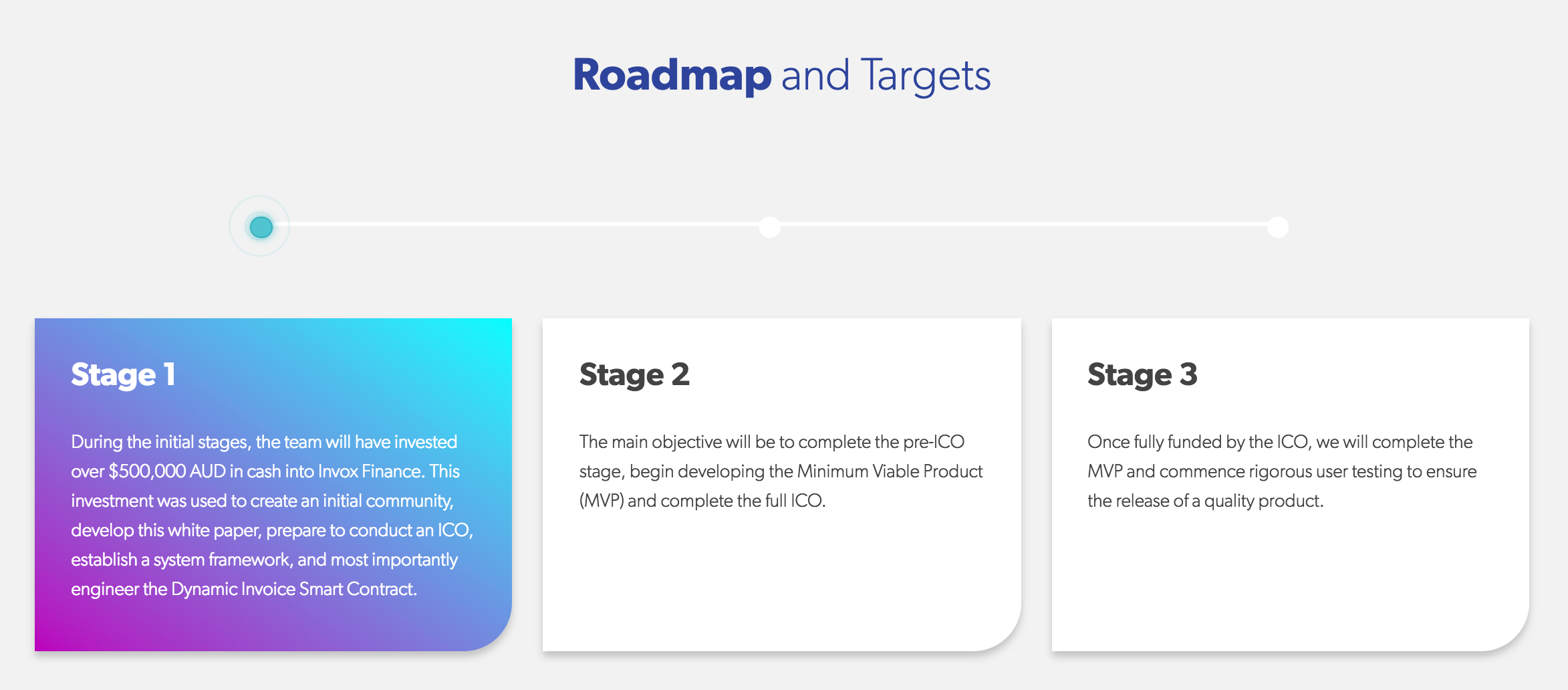

Roadmap

Team

For More Information Please Visit Here :

- Website : https://www.invoxfinance.io/

- Whitepaper : https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

- Twitter : https://twitter.com/InvoxFinance

- Facebook : https://www.facebook.com/invoxfinance/

- Github : https://github.com/invoxfinance

- Linkedin : https://www.linkedin.com/company/invox-finance/

- Telegram : https://t.me/InvoxFinanceCommunity

- Instagram : https://www.instagram.com/invoxfinance/

- Reddit : https://www.reddit.com/r/InvoxFinance/

Komentar

Posting Komentar